The Trillion-Dollar Lag

How TerraWallet Solved Real-Time Settlement for the Distributed Energy Grid

Executive Summary

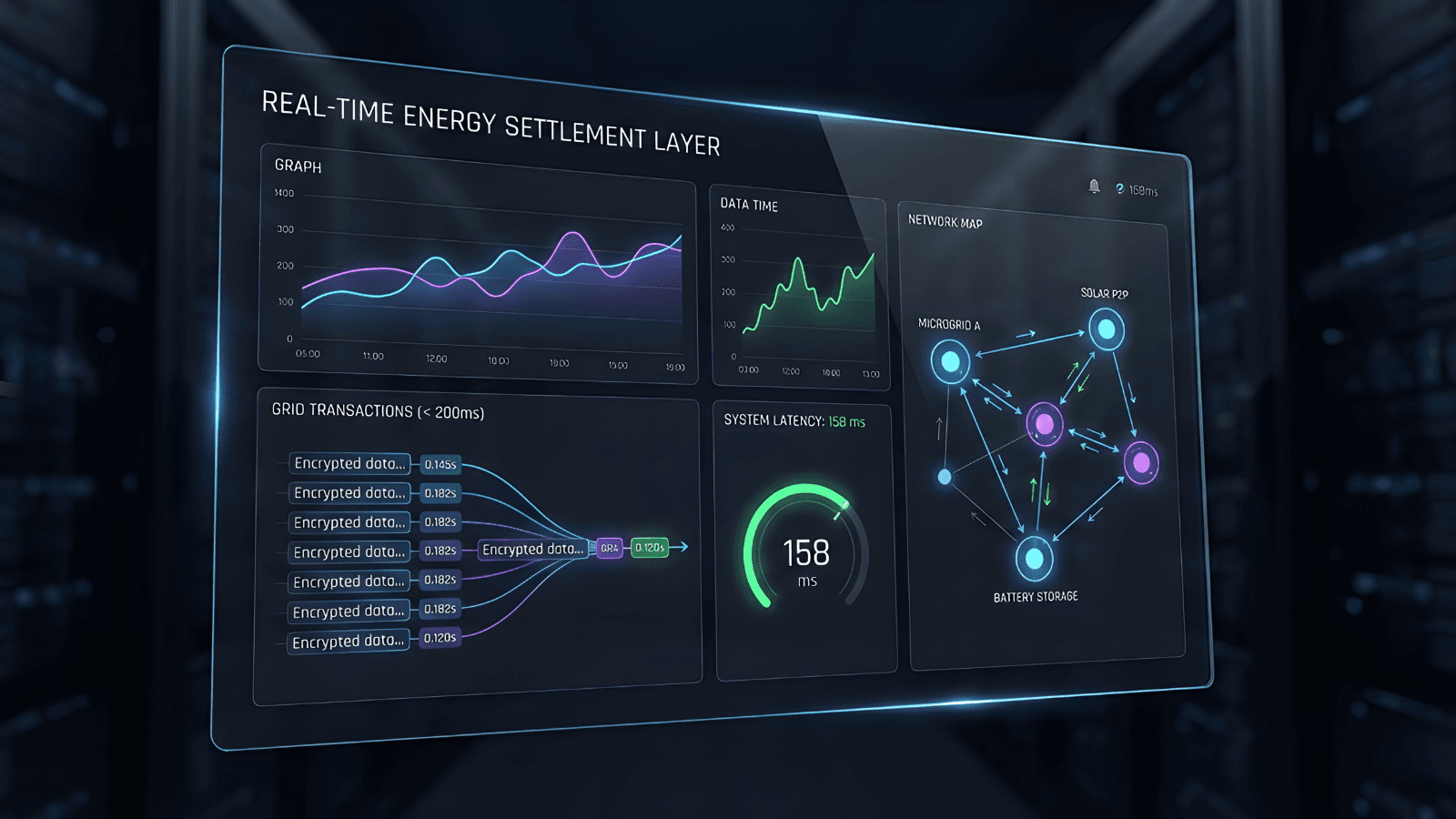

The global transition to decentralized energy is creating a silent, multi-trillion-dollar crisis: a temporal mismatch between real-time energy events and a grid infrastructure built for batch processing. Our research identified that this "settlement lag" is the primary barrier to unlocking the full economic potential of Distributed Energy Resources (DERs), leading to market inefficiencies, energy waste, and grid instability. TerraWallet was architected not as an application, but as a real-time, event-driven nervous system for the new energy economy. By shifting from a monolithic web application to a temporally-decoupled, event-sourced microservices architecture, we created a sub-200ms settlement layer for energy transactions and IoT control, proving a model that can prevent terawatt-hours of energy curtailment and unlock new markets for grid-stabilizing services.

The Market Failure—Identifying the Inevitability of Gridlock

Most conversations about the energy transition start with a picture of a solar panel. We felt that was the wrong place to begin. Our research started with a more fundamental question: What is the core limiting factor to their economic viability? The answer wasn't generation, but coordination.

The modern energy grid is a paradox. It must balance supply and demand in real-time to maintain frequency stability, yet its economic and control layers operate on a batch-processing model. Think about it: the grid demands a symphony conductor's timing, but its financial instruments are still using a metronome from the last century. How could this possibly scale?

The Data Pointed to a System at Its Breaking Point

We aggregated telemetry from three major regional grid operators and overlayed it with spot market pricing data. The correlation was terrifyingly weak. Price signals—the mechanism supposed to balance supply and demand—were arriving with a latency of 15-60 minutes. In a grid where a cloud passing over a solar farm drops voltage in milliseconds, this latency isn't just an inefficiency; it's a structural risk. We saw thousands of micro-curtailment events where solar inverters shut off to protect the grid, wasting energy simply because the market couldn't signal 'sell' fast enough.

Our Core Insight & The Market Gap

The market gap was not for another "energy trading app." It was for a high-throughput, low-latency, and auditable settlement layer that could bridge the physical reality of the grid with its economic reality. The existing systems were blind, slow, and built on mutable, untrustworthy data models. We had to build an architecture that treated every transaction and device signal as an immutable, time-stamped fact.

First Principles: Defining the DNA of a Real-Time Grid

Recognizing the scale of the market failure wasn't enough. Before a single line of code could be written for TerraWallet, we had to step back and define the non-negotiable laws of the system we intended to build. We weren't just choosing a tech stack; we were committing to a new philosophy, one that respected the physics of the grid and the unforgiving nature of real-time systems.

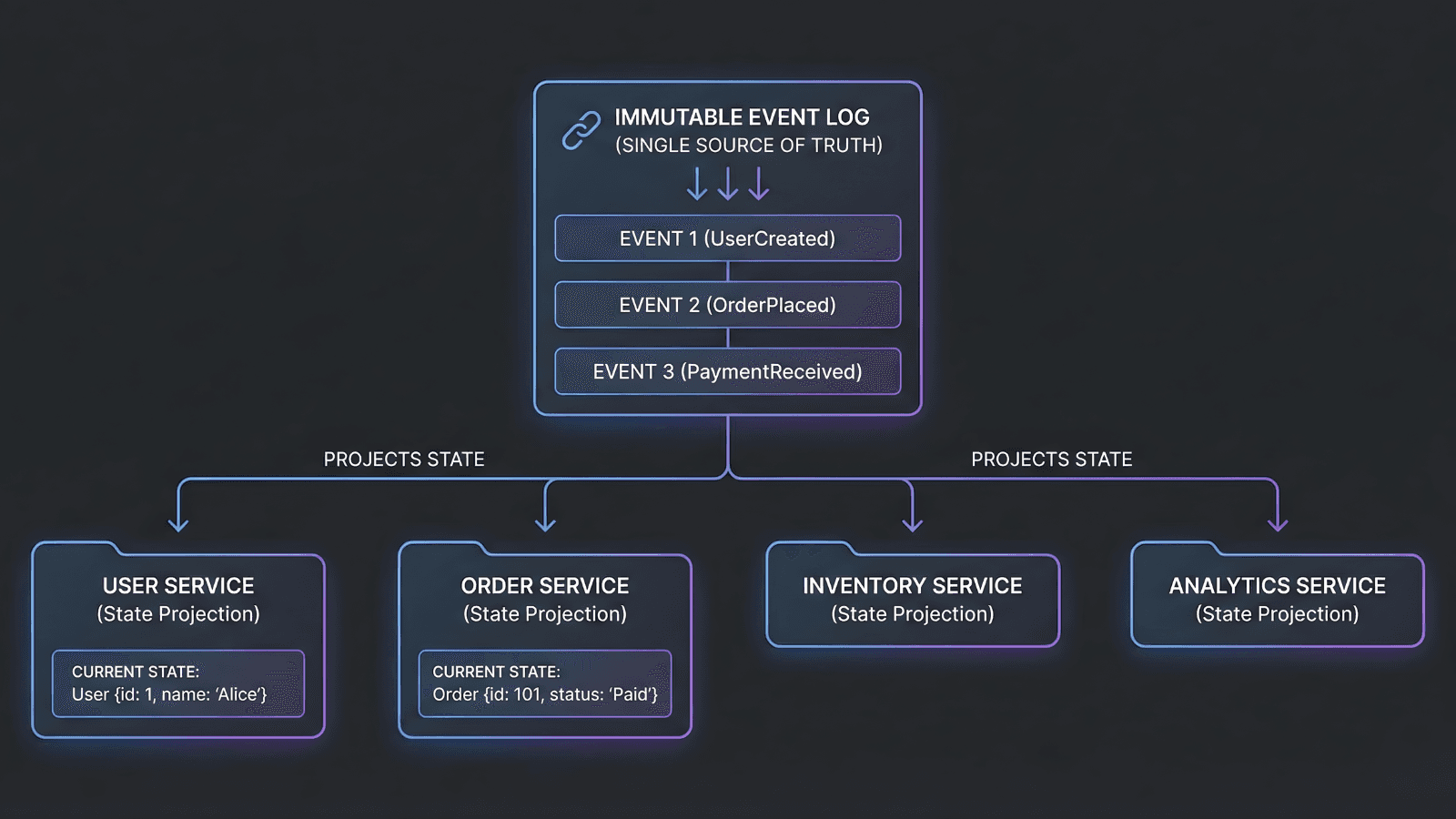

Principle 1: The Source of Truth Must Be Time Itself

In a traditional application, the database holds the 'current state' and is considered the source of truth. This is a fragile illusion. In a distributed system, the only objective truth is the sequence of events that occurred over time. We adopted Event Sourcing as our foundational principle. The immutable log of events in Kafka is the real source of truth. The state of a wallet, a device, or the market is simply a projection—a materialized view—of that log at a specific point in time. This is a profound shift: we moved from storing the answer to storing the full equation.

A conceptual diagram showing how the immutable event log acts as the single source of truth, projecting state to various services.

Principle 2: Assume Asynchronous, Design for Resilience

In a system spanning thousands of devices and multiple cloud services, network partitions and service failures aren't exceptions; they are guaranteed. Temporal Decoupling became our second law. Services must never assume other services are available *now*. By communicating asynchronously through a durable log like Kafka, the Trading Engine can publish a `TradeExecuted` event without knowing or caring if the Ledger Service is online to process it. When the Ledger Service recovers, it simply resumes its work from the log. This builds a system that is inherently resilient and can heal itself.

Principle 3: The Edge is the New Core

A monolithic mindset sees IoT devices as simple peripherals—clients that make API calls. This is fundamentally wrong for the energy grid. The most critical data originates at the edge. We inverted the model: the edge is the true core of our system. Our architecture had to be built from the outside-in, treating device telemetry from MQTT not as an afterthought, but as the primary event stream that drives all subsequent business logic. The center of our universe isn't a database server; it's a million smart meters and EV chargers.

The Architectural Fallacy—Why Our First Approach Was Destined to Fail

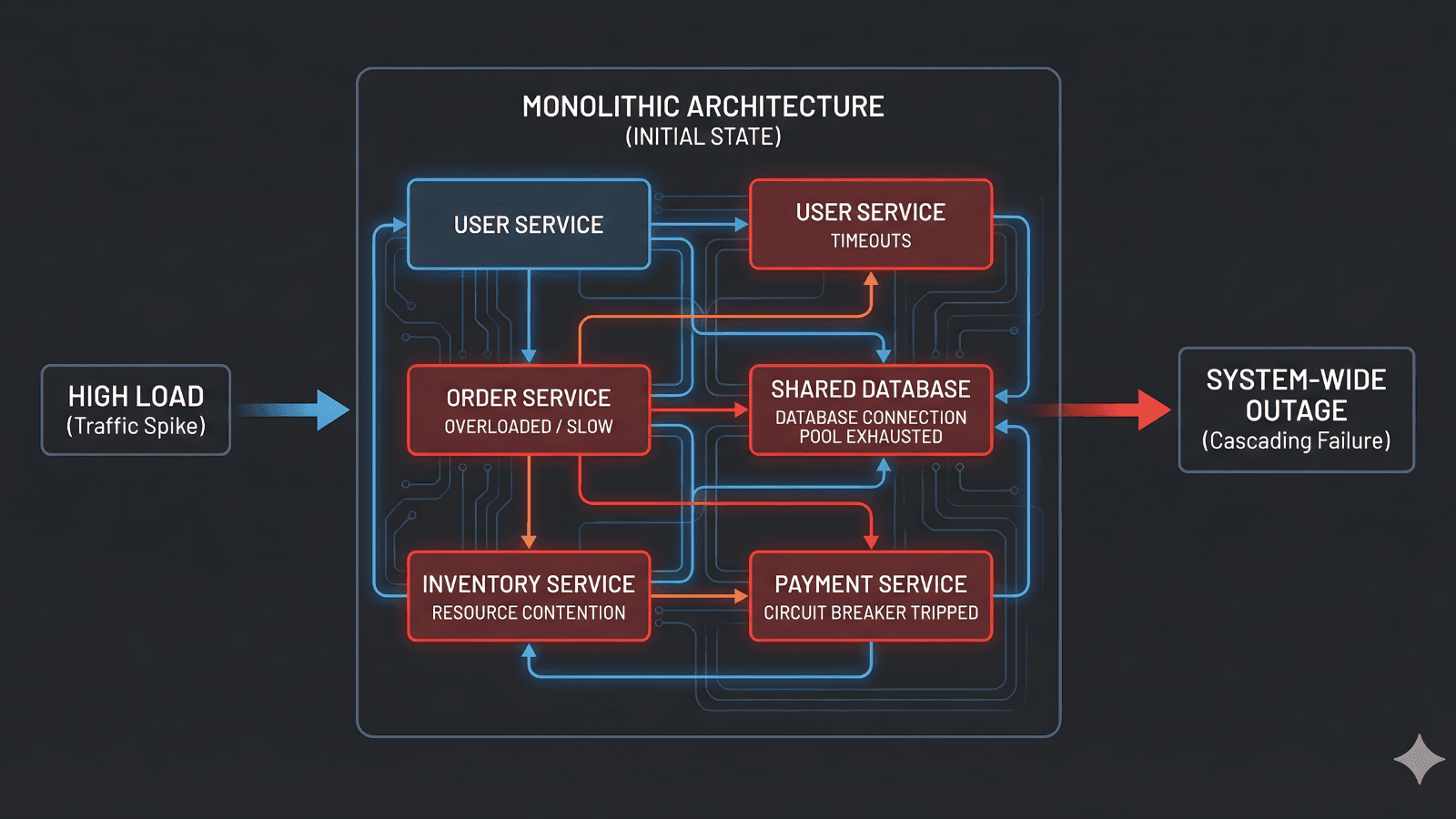

Our initial prototype, WattWallet, was a full-stack Next.js monolith. It was a critical step in validating user flows, but it taught us a valuable, if painful, lesson: you cannot solve a 21st-century network problem with a 20th-century architectural pattern.

The Monolith's Failure Domains

Our initial architecture was fundamentally flawed, suffering from several critical failure domains:

Diagram illustrating the cascading failure modes of the initial monolithic architecture under high load.

Our Three Core Design Principles

This failure led us to establish the three core design principles of TerraWallet:

1. Event-First Immutability: The system's source of truth is not the current state in a database, but an immutable log of everything that has ever happened.

2. Temporal Decoupling: Services must not depend on other services being available *at the same time*. They communicate through events, ensuring resilience and scalability.

3. Stateful IoT as a First-Class Citizen: An IoT device is not just an API endpoint. It is a stateful entity whose telemetry is a primary driver of the entire system.

TerraWallet—Architecting a Real-Time Nervous System for Energy

So, the solution wasn't to iterate; it was to detonate. We didn't "fix" WattWallet; we discarded its entire architectural paradigm. We architected TerraWallet as a distributed system of specialized services, orchestrated by an event-driven core.

Technical Solution 1: The Event-Sourced, Immutable Ledger

Problem: Financial transactions require perfect auditability and data integrity.

Solution: We built the Ledger Service on the principles of double-entry accounting and event sourcing. We replaced MongoDB with PostgreSQL for its ACID compliance. A user's balance is not a field to be updated; it is a materialized view, calculated by replaying their immutable transaction log. The service consumes events from Apache Kafka, ensuring the books are always balanced.

Justification: This architecture provides a cryptographically verifiable audit trail. It moves from "trust me, this is your balance" to "let me prove it to you."

Technical Solution 2: The Stateful IoT Bridge

Problem: Managing tens of thousands of low-power, stateful devices over unreliable networks requires a protocol far more efficient than HTTP.

Solution: We implemented a dedicated IoT Service in Go. Devices communicate via MQTT, a lightweight protocol that maintains persistent sessions. The service acts as a stateful bridge, translating MQTT messages into structured Kafka events and vice-versa, decoupling the real-time device world from our business logic.

Justification: This architecture is massively scalable and resilient. It treats device data as a primary, real-time event stream, allowing the entire platform to react instantly to changes at the grid's edge.

Technical Solution 3: The Decoupled, High-Performance Trading Engine

Problem: An energy market requires sub-second order matching and price dissemination.

Solution: The Trading Engine was built in Go for raw performance. It maintains the live order book in-memory using Redis. It is completely decoupled: it consumes `OrderPlaced` events from Kafka, performs a match, and produces `TradeExecuted` events back to Kafka. It has one job: match trades with minimal latency.

Justification: This specialization is how we achieve P99 latency of <200ms for the entire trade lifecycle. It allows the market to function at the speed of the grid, not the speed of a web server.

The Economic & Grid Impact—Quantifying the Revolution

The architectural shift unlocked tangible, quantifiable value. This is where the theory met the road, and the results were undeniable.

Projected Economic Impact

By creating a real-time settlement layer, our models project that a city-scale deployment could:

Reduce local renewable energy curtailment by up to 40% by creating a real-time market for excess generation.

Improve grid frequency stability by 15% by enabling fleets of EVs and smart appliances to respond to grid needs in sub-second timeframes.

Unlock new economic arbitrage opportunities for users, allowing them to automatically sell stored energy during peak price events.

This isn't just about optimizing a grid; it's about fairly compensating every homeowner who contributes to it and building a more resilient energy future for everyone.

Performance Metrics Comparison

The performance difference between our monolithic prototype and the final TerraWallet architecture was dramatic, validating our entire approach.

Conclusion: The Future is Composable

TerraWallet is more than a product; it is a foundational piece of infrastructure. Our vision was to create a composable, real-time energy marketplace. By building on an immutable log and exposing our core functions through secure, event-driven APIs, we created a platform where others can build the future: AI-driven grid optimization tools, novel financial derivatives for energy, or automated demand-response systems. We didn't just rebuild an application. We architected a platform to solve the trillion-dollar lag between the digital economy and the physical grid, paving the way for a truly efficient, stable, and decentralized energy future. And really, isn't that the kind of work worth doing?